How recent tax changes may affect the FEIE Standard Deduction

Wiki Article

All About the Foreign Earned Revenue Exclusion: Optimizing Your Criterion Reduction Benefits

The Foreign Earned Earnings Exemption (FEIE) presents a beneficial opportunity for united state people living abroad to reduce their tax obligation responsibilities. Understanding the qualification standards is vital for those looking for to benefit from this exclusion. Declaring the basic reduction can enhance total tax obligation advantages. Nonetheless, managing this procedure includes mindful focus to information and an understanding of typical pitfalls. Exploring these facets can provide clarity and maximize potential tax benefits.Understanding the Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Revenue Exemption (FEIE) permits united state residents and resident aliens working abroad to omit a section of their international profits from federal income tax. This provision serves as a financial relief mechanism, enabling expatriates to keep a bigger share of their revenue gained in foreign countries. By reducing gross income, the FEIE assists reduce the concern of double taxes, as individuals might additionally undergo taxes in their host countries. The exclusion applies only to earned revenue, that includes incomes, salaries, and expert fees, while passive income and investment gains do not certify. To take advantage of the FEIE, people need to file particular forms with the internal revenue service, describing their foreign revenues and residency - FEIE Standard Deduction. Comprehending the nuances of the FEIE can greatly influence monetary planning for united state citizens living overseas, making it important for migrants to stay educated regarding this beneficial tax obligation provisionEligibility Requirements for the FEIE

To get approved for the Foreign Earned Earnings Exemption (FEIE), individuals have to meet details eligibility requirements. This consists of gratifying residency requirements, passing the physical visibility test, and developing a tax home in an international country. Each of these factors plays a crucial function in establishing whether one can profit from the exclusion.Residency Demands

Fulfilling the residency demands is necessary for people looking for to get the Foreign Earned Revenue Exclusion (FEIE) To be eligible, taxpayers must establish an authentic residence in an international country or countries for an uninterrupted period that generally covers a whole tax year. This need highlights the need of a deeper connection to the foreign location, moving beyond simple physical existence. Individuals need to show their intent to stay in the international nation and have established their living situation there. Elements such as the length of keep, sort of real estate, and local community involvement are thought about in establishing residency. Meeting these criteria is important, as failure to do so may disqualify one from taking advantage of the FEIE.Physical Visibility Examination

Developing qualification for the Foreign Earned Earnings Exclusion (FEIE) can also be achieved via the Physical Presence Examination, which requires individuals to be physically present in a foreign nation for a minimum of 330 complete days throughout a successive 12-month duration. This examination is advantageous for those who might not meet the residency demand however still live abroad. The 330 days must be full days, implying that any day invested in the United States does not count towards this overall. It is important for individuals to maintain exact documents of their traveling days and locations to support their claims. Successfully passing this examination can significantly decrease taxed earnings and improve economic outcomes for migrants.Tax Home Place

Tax home area plays a necessary function in identifying qualification for the Foreign Earned Income Exemption (FEIE) To qualify, a specific must develop a tax home in an international country, which implies their key business is outside the USA. This is unique from a mere house; the individual should perform their operate in the international country while preserving a substantial connection to it. The internal revenue service requires that the taxpayer can demonstrate the intent to stay in the international location for an extended duration. In addition, maintaining a home in the U.S. can make complex qualification, as it may recommend that the person's true tax home is still in the USA. Understanding this requirement is important for optimizing FEIE benefits.How to Assert the FEIE on Your Tax Return

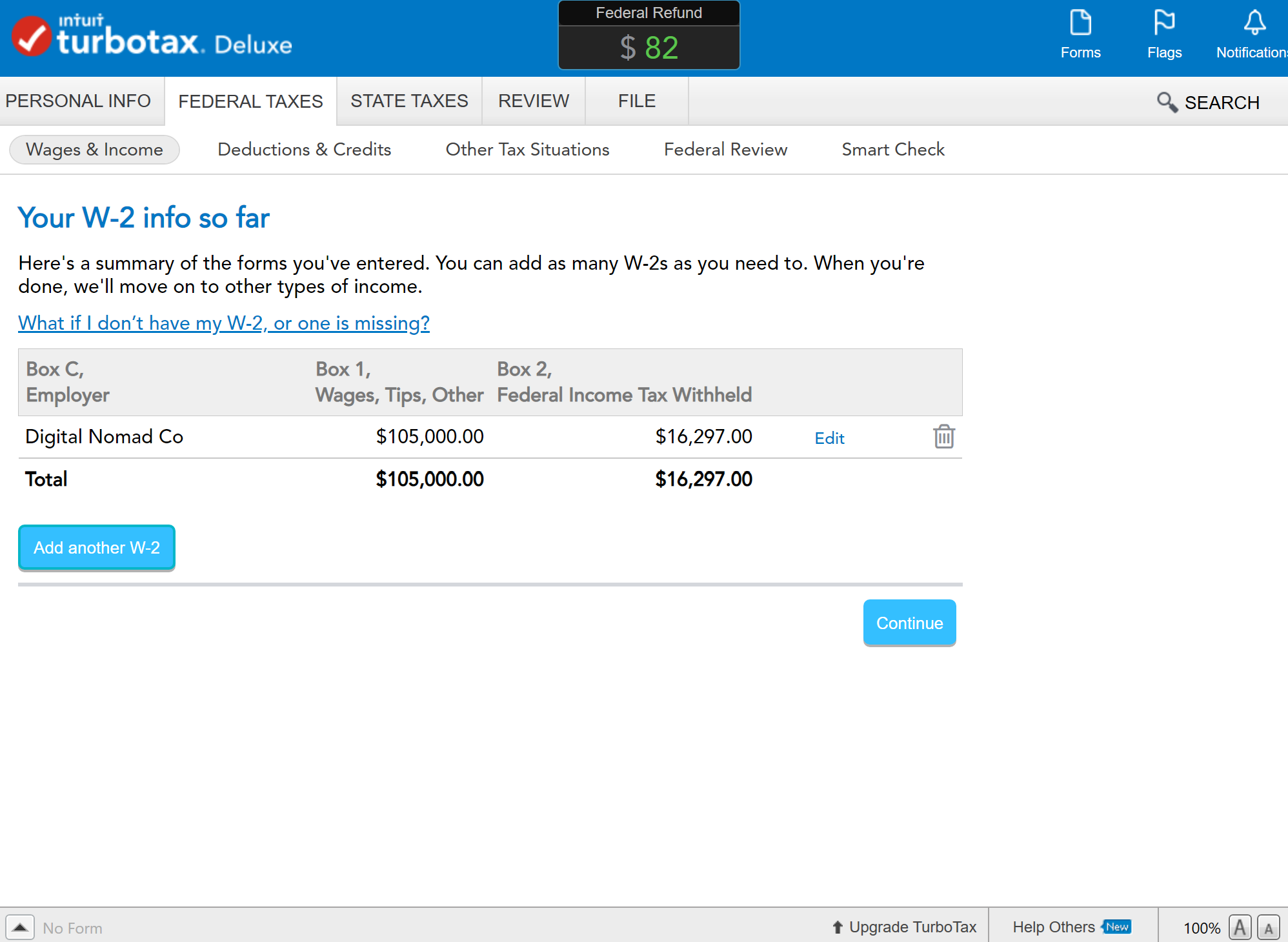

Asserting the Foreign Earned Earnings Exemption (FEIE) on an income tax return calls for cautious attention to information and adherence to specific IRS guidelines. Taxpayers should first confirm qualification by satisfying either the authentic home test or the physical existence test. When eligibility is confirmed, they should complete IRS Type 2555, which details international gained revenue and relevant information concerning their tax obligation home.It is necessary to report all foreign earnings precisely and preserve ideal documentation to sustain cases. Taxpayers should additionally be aware of the maximum exemption limit, which goes through annual adjustments by the internal revenue service. Declaring Type 2555 alongside the annual income tax return permits taxpayers to omit a portion of their foreign revenues from united state taxation. It is suggested to consult a tax obligation expert or Internal revenue service resources for upgraded info and advice on the FEIE process, guaranteeing compliance and maximization of possible benefits.

The Standard Deduction: What You Need to Know

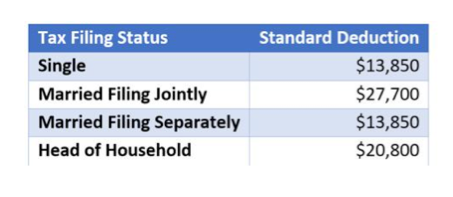

Just how does the basic deduction influence taxpayers' general monetary situation? The standard reduction serves as a significant tax obligation benefit, decreasing taxable revenue and possibly reducing tax liabilities. For the tax year 2023, the basic deduction is evaluated $13,850 for single filers and $27,700 for married couples submitting jointly. This deduction streamlines the declaring process, as taxpayers can select it rather of making a list of reductions, which requires thorough record-keeping.

Taxpayers earning foreign revenue might still assert the basic deduction, taking advantage of reduced gross income also while using the Foreign Earned Revenue Exemption (FEIE) However, it is important to note that the common reduction can not be combined with itemized deductions for the exact same tax year. Understanding the conventional reduction permits taxpayers to make educated decisions concerning their tax obligation techniques, making the most of offered advantages while making sure conformity with Internal revenue service policies.

Strategies for Maximizing Your Reductions

Making the most of deductions under the Foreign Earned Revenue Exclusion calls for a clear understanding of gained earnings restrictions and the benefits of claiming real estate exemptions. Additionally, utilizing Form 2555 successfully can improve the capacity for substantial tax financial savings. These methods can considerably affect the total tax obligation liability for migrants.Understand Gained Income Restrictions

While lots of migrants seek to decrease their tax worry, recognizing the gained income limits is necessary for properly leveraging the Foreign Earned Earnings Exemption. The Irs (IRS) establishes particular limits that dictate the maximum quantity of international made revenue eligible for exemption. For the tax year 2023, this limit is $120,000 per qualified person. Surpassing this threshold might lead to tax on the income above the restriction, decreasing the advantages of the exclusion. To make the most of deductions, expatriates need to maintain exact records of their international made earnings and analyze their eligibility for the exclusion each year. Strategic preparing around these restrictions can considerably enhance tax cost savings, permitting expatriates to optimize their financial situation while living abroad.Declaring Housing Exclusion Perks

Lots of expatriates ignore the prospective benefits of claiming the Real estate Exclusion, which can significantly reduce their taxed income. This exemption allows individuals living abroad to subtract specific real estate costs from their gross revenue, making it much easier to fulfill financial commitments without incurring substantial tax responsibilities. To optimize this benefit, expatriates ought to validate they certify based upon their home and work scenarios. In addition, understanding eligible expenses-- such as rental fee, utilities, and maintenance-- can boost the overall reduction. Maintaining complete documents of these prices is vital for validating claims. By strategically steering via the Housing Exclusion, expatriates can significantly lower their tax worry and keep more of their profits while living overseas, ultimately improving their monetary wellness.Utilize Form 2555 Efficiently

Utilizing Form 2555 efficiently can considerably improve the economic advantages readily available to expatriates, specifically after making use of the Real estate Exclusion. This type enables individuals to declare the Foreign Earned Earnings Exclusion, which can considerably reduce gross income. To make best use of reductions, migrants must verify they satisfy the qualifications, including the physical presence examination or the bona fide home examination. It is vital to properly report all foreign gained revenue and to maintain detailed records of eligibility. Furthermore, using the Real estate Exemption in tandem with Form 2555 can better decrease general tax obligation obligation. By recognizing the intricacies of these kinds, migrants can maximize their tax obligation scenario and preserve more of their hard-earned revenue while living abroad.Usual Risks to Avoid When Filing Your Tax Obligations Abroad

Frequently Asked Inquiries

Can I Assert Both FEIE and the Foreign Tax Obligation Credit History?

Yes, an individual can declare both the Foreign Earned Revenue Exclusion (FEIE) and the Foreign Tax Credit (FTC) However, they must guarantee that the very same income is not utilized for both benefits to prevent double advantages.What Occurs if I Surpass the FEIE Revenue Limit?

Exceeding the Foreign Earned Earnings Exemption (FEIE) earnings restriction leads to the ineligibility for the exclusion on the excess quantity. This could lead to gross income in the USA, requiring appropriate tax filings.Exist Any Kind Of State Tax Obligation Ramifications for FEIE?

State tax implications for the Foreign Earned Earnings Exemption (FEIE) differ by state. Some states may exhaust international income while others follow government exclusions, making it important for individuals to speak with state-specific tax obligation guidelines for quality.

Exactly How Does FEIE Impact My Social Protection Conveniences?

The Foreign Earned Earnings Exclusion (FEIE) does not directly impact Social Protection advantages. However, revenue excluded under FEIE may impact the calculation of ordinary indexed month-to-month revenues, possibly affecting future advantages.Can I Revoke My FEIE Political Election After Asserting It?

Yes, a person can revoke their International Earned Earnings Exemption (FEIE) political election after claiming it. This retraction must be performed in creating and submitted to the internal revenue service, adhering to details guidelines and due dates.Understanding the Foreign Earned Earnings Exclusion (FEIE)

The Foreign Earned Income Exclusion EarningsFEIE) allows U.S. citizens united state people aliens working abroad functioning exclude a leave out of their foreign earnings international federal income taxRevenue Taxpayers making foreign revenue may still declare the conventional reduction, profiting from lowered taxed income also while making use of the Foreign Earned Earnings Exemption (FEIE) Maximizing deductions under the Foreign Earned Income Exemption calls for Read Full Article a clear understanding of gained revenue limits and the benefits of claiming real estate exclusions. While lots of migrants seek to minimize their tax obligation concern, understanding the made earnings limits is crucial for efficiently leveraging the Foreign Earned explanation Income Exclusion. Going Beyond the Foreign Earned Revenue Exclusion (FEIE) income limitation results in the ineligibility for the exemption on the excess quantity.

Report this wiki page